Corporate Tax Reduction: They Already Pay Much Less Than Required

Image for representational use only.Image Courtesy : HuffPost India

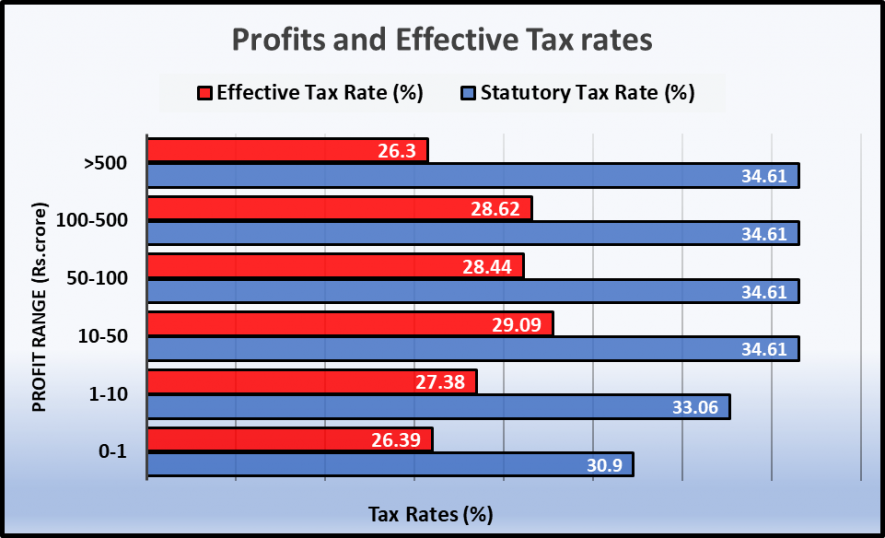

There is a proposal that corporate taxes should be reduced to 25% from 30%. According to reports, this has been mooted in a report submitted to the finance minister by a panel headed by Akhilesh Ranjan, member of the Central Board of Direct Taxes (CBDT). However, data on corporate taxes put out by the central government in Budget documents earlier this year shows that corporates are already paying much less than the statutory rates. In fact, the biggest corporate houses, with profits of more than Rs. 500 crore every year, pay only 26.3% tax although the statutory rate is 34.61%. [See chart below]

These figures are for 2017-18 and contained in Annexure 7 of the Receipts Budget, presented in July this year by the newly elected Modi government. It is based on an analysis of 8,41,687 corporate returns filed up to March 31, 2019 for the financial year 2017-18 [assessment year 2018-19]. These companies reported corporate tax liability of Rs. 4.48 lakh crore, inclusive of surcharge and education cess.

How much profit were these companies making? According to the document, 3.91 lakh companies (46.41% of all) reported Rs. 15.18 lakh crore as profits before taxes and taxable income of Rs. 11.24 lakh crore. But 3.61 lakh companies (43.11%) reported Rs. 9.08 lakh crore as losses and another 88,214 companies (10.48%) reported Nil profit. Many companies, it is suspected by observers, report no profit or even losses in order to evade taxes. But that’s another story.

When the government or tax bureaucrats talk of current tax rate being 30%, what they actually mean is the average statutory tax rate because these rates vary with the size of their incomes. For companies having income up to Rs. 1 crore, the tax rate is 30.9%; for companies having income up to Rs. 10 crore, it is 33.06%; and for companies having income exceeding Rs. 10 crore, it is 34.61%. A weighted average of this comes out to an average statutory rate of 34.40%.

Also read: During Modi 1.0, Over Rs. 4.3 Lakh Crore Worth of Tax Concessions Given to Corporates

As can be seen from the chart above, the highest rates of tax are being paid by the medium sized corporates with profits in the range of Rs. 10-50 crore. The smaller ones and the biggest ones pay less taxes.

Profile of the Biggies

There are only 373 companies that reported profit before tax of Rs. 500 crore or more. But, put together, this elite echelon of the industrial houses had an income of Rs. 8.86 lakh crore in 2017-18, accounting for over 46% of the income of all corporate houses. They paid Rs. 2.3 lakh crore in corporation taxes which was 52% of all taxes paid by all corporates. And yet, they had the lowest effective tax rates. Clearly the government had them in mind while doling out concessions and these biggies had taken full advantage of that.

Some of the sectors with low effective tax rates are: air transport (20.28%); purchase, sale and letting of leased (residential and non-residential) buildings (22.96%); collection, purification and distribution of water (17.36%); production, collection and distribution of electricity (20.95%); manufacture of cement, lime and plaster (22.30%); manufacture of pharmaceuticals, medicinal chemicals and botanical products (25.35%); manufacture of refined petroleum products (21.61%); and extraction of crude petroleum and natural gas (20.36%).

On the face of it, this list looks like tax concessions are given to public welfare oriented sectors. But, the fact is that most of these sectors are today having significant private sector shares. In other words, corporates involved in these activities (think, Reliance, Patanjali, Bisleri and Nestle, all the real estate tycoons, Jet Airways etc.) are effectively paying much less tax. And, ironically, many of these sectors are precisely those that are sinking, despite all the concessions!

How Do They Get Away with This?

All this is legal and above board. The government itself provides a slew of concessions to corporate houses. These are tax loopholes, often included in the statutes themselves and justified as being necessary to incentivise industries of certain kinds. The accumulated benefits from these concessions makes the difference between statutory and effective (or actual) tax rates.

The document, in fact, gives a projection for how much concessions have been given to corporate houses. It’s a staggering figure – Rs. 1.09 lakh crore for the year 2017-18. This is up from Rs. 93.6 thousand crore in the previous year.

Also read: Income Tax Data Shows Corporate Concessions

Prime Minister Modi talked about “wealth creators” (read corporates) in his Independence Day speech on August 15, saying they deserve respect and should not be viewed with suspicion. He said that “if wealth is not created, it will not be distributed and the poor in the country will not benefit”. The latest suggestion of reducing corporate taxes is in line with this thinking. But with all the concessions already garnered by these elite corporates, there seems to be little evidence of any good coming out of it for the people.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.